PRESENTING

Magnum Hybrid

Long Short Fund

An Interval investment strategy investing predominantly in equity and debt securities, including limited short exposure in equity and debt through derivatives

NFO PERIOD

October 01, 2025 to October 15, 2025

Navigate Market Uncertainty with Confidence

In times of global slowdowns, policy changes, and market swings, the Magnum Hybrid Long Short Fund offers flexibility, discipline, and professional expertise to help you stay invested with confidence.

What Makes SIF Different?

The Specialized Investment Fund (SIF) Advantage

Specialized Investment Fund (SIF) is a new SEBI-introduced investment framework, bridging the gap between mutual funds and portfolio management services (PMS). This fund category offers regulatory transparency, professional management, and a flexible structure, allowing strategic asset allocation across equity, debt, and alternative instruments, while retaining the post-tax returns of equity mutual funds

Bridges the Gap

Combines strengths of Mutual Funds and Portfolio Management Services (PMS) in a flexible, regulated investment structure.

Tax Efficiency

Enjoys equity taxation like Mutual Funds for better post-tax return potential.

Lower Barrier

Minimum investment of ₹10 lakhs, lower than typical PMS entries.

Presenting The Magnum Hybrid Long Short Fund

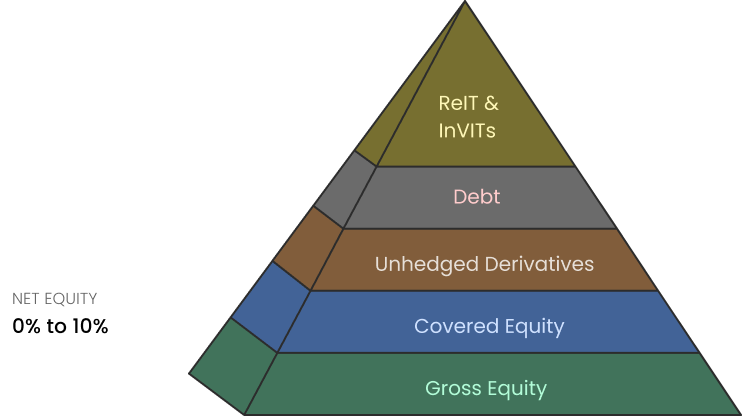

Magnum Long Short Hybrid Fund aims to thoughtfully allocate investments across multiple asset classes and instruments - such as equity, fixed income, derivatives and REITs/InvITs to seamlessly navigate market cycles. The strategy seeks to deliver potential growth and lower volatility, achieving optimal risk-adjusted returns and staying ahead not just by managing risk, but by turning it into opportunity.

How Would the Fund Allocate Its Assets

For detailed asset allocation, investors are requested to refer to the Investment Strategy Information Document (ISID) of the Fund.

How SIFs Stack Up Against Other Investment Avenues

| Feature | SIF | MF | PMS | AIF |

|---|---|---|---|---|

| Target Investors | Investors Seeking advanced yet tax-efficient strategies | First time to long-term investors | HNIs desiring personalized portfolio management | Ultra-HNIs & Institutions exploring non-traditional assets |

| Minimum Investment | ₹10 Lakh (Across SIF Strategy) | ₹5,000 (Lumpsum) | ₹50 Lakh | ₹1 Crore |

| Structure | Hybrid between MF & PMS/AIF, retains MF-like taxation | Pooled, SEBI-regulated investment vehicle | Separately managed, direct stock ownership | Pooled, privately placed schemes |

| Taxation at Investor Level | Similar to Mutual Funds (depending on asset class) | Tax-efficient with indexation & capital gain benefits | Based on individual security treatment | Pass-through taxation depending on category |

| Taxation at Fund Level | Nil as per Section 10(23D) | Nil as per Section 10(23D) | Nil | Cat III - Capital gains @12.5% + Business Income @MMR |

| Expense Ratio | Max at 2.25% and 2% | Max at 2.25% and 2% | Management Fee + Performance Fee | Management Fee + Performance Fee |

| Leverage | NA | NA | NA | Allowed - Gross exposure upto 200% |

| Derivatives | Naked shorts upto 25% + Hedging | Only for Hedging | Only for Hedging | Allowed |

*As per current Income Tax Laws. Please consult your investment / tax advisor before making any investment decision.

Fund Details

The investment objective of the Investment Strategy is to generate regular income by predominantly investing in Derivatives strategies like covered calls, arbitrage opportunities in the cash and derivatives segments of the equity markets and debt and money market instruments and generate long-term capital appreciation through unhedged exposure to equity and equity related instruments. There is no assurance that the investment objective of the Investment strategy will be achieved.

| Attributes | Description |

|---|---|

| Benchmark | NIFTY 50 Hybrid Composite Debt 50:50 Index TRI |

| Redemption Frequency | Twice In a Week (Monday And Thursday) |

| Plan & Options | Regular & Direct Plan; Both Plan Provide Two Options – Growth Option And Income Distribution Cum Capital Withdrawal (IDCW) Option |

| Exit Load |

>0.50%: If Redeemed On Or Before 15 Days >0.25%: If Redeemed After 15 Days But On Or Before 1 Month >No Exit Load After 1 Month |

| Minimum Application Amount | Rs. 10 Lakh |

| Redemption Notice Period | NIL |

| Exchange Listing | To Be Listed On National Stock Exchange & BSE Limited |

This product is suitable for investors who are seeking*:

- Long term Capital appreciation

- An Interval investment strategy investing predominantly in equity and debt securities, including limited short exposure in equity and debt through derivatives.

Risk Band

Risk - Level 2

Benchmark Risk - Band

Nifty 50 Hybrid Composite Debt 50:50 Index

Risk - Level 2

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the characteristics of the investment strategy or model portfolio and the same may vary post NFO when the actual investments are made.

Ready to Invest with Confidence?

Start your investment journey with Magnum Hybrid Long Short Fund today